When it comes to Forex trading, timing can be just as crucial as strategy and analysis. Knowing the best time to trade Forex can significantly impact your ability to capitalize on market movements. The Forex market is open 24 hours a day, five days a week, but not all hours are created equal. Depending on the currency pairs you trade, the economic indicators you're following, and the trading platforms you use, certain times of the day may offer better opportunities than others. In this guide, we’ll explore how market sessions, volatility, and key economic events influence the best time to trade Forex, helping you make more informed decisions.

Understanding the Forex Market and Trading Times

Understanding when to trade Forex is crucial for maximizing profits. The Forex market operates 24/5, and factors such as market hours, time zones, and liquidity play a key role in trading success.

1. What is Forex Trading?

Forex (foreign exchange) trading involves buying and selling currencies to profit from market fluctuations. Unlike stock markets, Forex operates globally with no centralized exchange, offering traders flexibility to trade anytime within the market hours.

Global reach: Forex connects traders from all over the world, creating a highly liquid and dynamic marketplace.

Currency pairs: Common pairs include EUR/USD, GBP/USD, and USD/JPY. These pairs are central to most trading strategies.

24-hour market: The Forex market operates around the clock, with trading sessions overlapping across major financial centers.

2. Market Hours and Time Zones: A Key Factor in Trading Forex

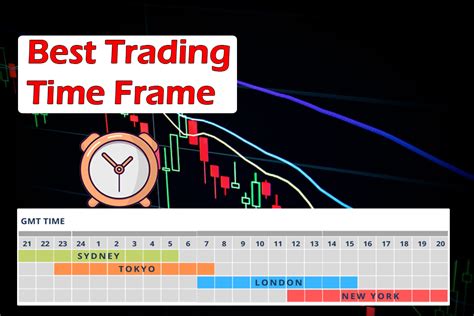

The Forex market is open 24 hours a day, but not all hours are equally advantageous for trading. The trading day is divided into three main market sessions: London, New York, and Tokyo. These sessions provide different liquidity and volatility.

London session: Starts at 8:00 AM GMT. It is the most liquid and volatile time due to the overlap with the Tokyo session.

New York session: Begins at 1:00 PM GMT. It overlaps with the London session and is known for large price movements.

Tokyo session: Starts at 11:00 PM GMT. It’s typically quieter with lower volatility but can provide opportunities during Asian market hours.

Comparison of Forex Market Sessions

| Session | Time (GMT) | Major Currency Pairs | Liquidity | Volatility |

|---|---|---|---|---|

| London Session | 8:00 AM - 4:00 PM | EUR/USD, GBP/USD, EUR/GBP | High | High |

| New York Session | 1:00 PM - 9:00 PM | USD/JPY, USD/CHF, EUR/USD | High | High |

| Tokyo Session | 11:00 PM - 7:00 AM | USD/JPY, EUR/JPY, AUD/USD | Medium | Low |

3. Peak Trading Hours: When to Trade Forex for Maximum Profitability

Peak trading hours occur when two major market sessions overlap, providing more liquidity and higher potential for profit.

London-New York Overlap: The period between 1:00 PM and 4:00 PM GMT is considered the best time to trade Forex. It offers maximum market activity and price movement, especially for pairs like EUR/USD and GBP/USD.

Key volatility drivers: During these times, both economic data releases and the market’s response to news can drive significant volatility, creating ample opportunities for traders.

Optimal trading times: Traders can use technical indicators like Moving Averages and RSI during peak hours to identify trends.

4. Weekend and Holiday Effects on Forex Trading

Forex markets may seem like they never close, but weekends and holidays affect trading dynamics. These periods often result in wider spreads and lower liquidity.

Weekend gaps: Markets can experience gaps between Friday’s close and Monday’s open, creating potential risk for traders.

Holiday trading: Public holidays, such as Christmas or New Year’s Day, lead to reduced market activity and may cause slippage or less predictable movements.

Strategy tips: Avoid trading during these times unless experienced, as lower liquidity can lead to unpredictable market conditions.

5. Forex Market Liquidity and Volatility

Liquidity and volatility are key factors that influence the best time to trade Forex. Liquidity refers to the ease of executing a trade, while volatility refers to price fluctuations.

High liquidity: Found during the London and New York sessions, where more trades occur, and spreads are typically narrower.

Volatility’s role: During volatile periods (such as when the US Nonfarm Payroll report is released), price movements can be dramatic, but also riskier.

Trading strategy: Traders use indicators like the Average True Range (ATR) or Bollinger Bands to measure volatility and adjust their positions accordingly.

The best time to trade Forex is dependent on market hours, liquidity, and volatility. Understanding the characteristics of each trading session and the impact of economic indicators can help you time your trades for maximum profitability.

Factors Affecting Forex Trading Hours

Forex trading hours are influenced by several factors, including market liquidity, economic events, and trading platforms like MetaTrader 4 or TradingView. Understanding these can significantly improve trading strategy and timing.

1: Economic Events and News Releases

Economic events such as Interest Rate decisions, Nonfarm Payrolls, and GDP releases can create volatility, impacting Forex trading hours.

Major news releases, particularly from the US Dollar (USD) or Euro (EUR) economies, often cause sharp market movements.

Inflation reports and Retail Sales data can lead to market fluctuations, making certain hours more favorable for high-impact trades.

2: Currency Pair Volatility at Different Hours

The volatility of currency pairs like EUR/USD, USD/JPY, or GBP/USD varies during different hours of the trading day.

Overlap periods (such as the London/New York overlap) see the highest volatility.

Low volatility periods occur during the early hours of the trading day, especially after major market closures.

Cross-pair trading, such as EUR/GBP or AUD/USD, might be more active in certain time zones.

3: Impact of Liquidity on Forex Trading Hours

Liquidity is one of the most crucial factors for Forex trading.

High liquidity periods are typically seen when major markets like London and New York overlap.

The EUR/USD pair, as one of the most liquid, responds faster during these periods, while less liquid pairs like NZD/USD may be slower.

Market Depth, influenced by the number of active traders, plays a role in determining the ease of executing trades without large price shifts.

| Trading Session | Peak Liquidity | Volatility Levels | Most Traded Pairs | Recommended Platforms |

|---|---|---|---|---|

| London Session | High | Moderate | EUR/USD, GBP/USD | MetaTrader 4, cTrader |

| New York Session | High | High | USD/JPY, EUR/USD | Thinkorswim, eToro |

| Tokyo Session | Moderate | Low | USD/JPY, EUR/JPY | NinjaTrader, TradingView |

| Sydney Session | Low | Low | AUD/USD, NZD/USD | MetaTrader 5 |

4: Market Overlaps and Their Influence on Trading Hours

The London-New York overlap is widely regarded as the most dynamic and profitable time to trade Forex, due to increased market liquidity and volatility.

Traders focusing on EUR/USD or GBP/USD should plan to trade during this overlap for the best opportunities.

The Sydney-Tokyo overlap tends to be quieter, but there may still be significant moves in pairs like AUD/USD or NZD/USD, particularly in response to economic reports from the Asia-Pacific region.

Best Times to Trade Specific Currency Pairs

The timing of Forex trades significantly impacts profitability. This cluster explores the best times to trade popular currency pairs, considering factors like liquidity, volatility, and market overlap. Let’s dive into key insights.

1. Best Time to Trade EUR/USD

The EUR/USD is one of the most traded currency pairs in the Forex market. The best time to trade this pair is during the overlapping of the London and New York sessions. This overlap provides increased liquidity and volatility, making it a prime time for active traders.

Optimal Trading Time: 8:00 AM to 12:00 PM EST

Why: Increased market activity and better spreads.

Key Factors: Economic reports from both the European Union and the U.S. influence this period.

2. Best Time to Trade USD/JPY

For the USD/JPY pair, the best time to trade is during the Tokyo and New York sessions. This is because the pair experiences high volatility due to overlapping market hours and economic data releases from both Japan and the U.S.

Best Time to Trade USD/JPY:

Optimal Trading Time: 7:00 PM to 2:00 AM EST

Why: Liquidity is high due to the Asian and U.S. market overlap.

Key Indicators: U.S. Nonfarm Payrolls and Japanese GDP data often move the market.

3. Best Time to Trade GBP/USD

The GBP/USD is sensitive to both U.S. and UK economic releases. The best time to trade this pair is during the London and New York session overlap. Economic reports like the UK's GDP and the U.S. Retail Sales significantly influence price movements.

| Time Zone | Market Activity | Currency Pairs to Watch | Key Economic Events |

|---|---|---|---|

| 8:00 AM – 12:00 PM EST | High Activity | GBP/USD, EUR/USD, USD/CHF | U.S. Retail Sales, UK GDP |

| 12:00 PM – 4:00 PM EST | Moderate Activity | GBP/USD, EUR/USD, USD/JPY | U.S. CPI, UK Interest Rate |

The table above shows the best trading periods and associated currency pairs. GBP/USD shows strong volatility during the peak overlap hours, especially when retail sales or GDP data is released.

4. Best Time to Trade AUD/USD

The AUD/USD pair typically reacts to economic data from both Australia and the U.S. The best time to trade is during the Sydney and London market overlap, providing strong movement as both markets are active.

Optimal Trading Time: 3:00 AM to 5:00 AM EST

Why: Economic releases from Australia and the U.S. create volatility.

Key Data Points: Australian employment numbers and U.S. inflation reports.

Understanding the best times to trade specific currency pairs like EUR/USD, USD/JPY, GBP/USD, and AUD/USD can drastically enhance trading performance. By considering market overlap and economic data releases, traders can optimize their strategies for better profitability.

Using Technical Indicators to Timing Forex Trades

Timing Forex trades effectively is essential for maximizing profitability. Technical indicators like the Moving Average, RSI, and Bollinger Bands help traders identify ideal entry and exit points. This cluster will explore how these tools can guide your trading strategy.

1. How Moving Averages Help Timing Forex Trades

Moving Averages (MA) smooth out price data to identify trends.

Traders use the Simple Moving Average (SMA) and Exponential Moving Average (EMA) to understand market direction.

Golden Cross and Death Cross signals indicate potential buy and sell opportunities.

MA crossovers show trend reversals or continuation.

Commonly used timeframes include 50-period, 100-period, and 200-period MAs.

2. Using RSI to Identify Overbought or Oversold Conditions

Relative Strength Index (RSI) helps traders gauge market momentum.

RSI ranges from 0 to 100, indicating whether a currency pair is overbought or oversold.

Over 70: Overbought, signaling potential reversal.

Below 30: Oversold, suggesting potential for upward movement.

Can be used with other indicators for confirmation of trade signals.

3. The Role of Bollinger Bands in Timing Forex Trades

Bollinger Bands measure market volatility and help traders identify potential breakouts.

The bands expand and contract based on price volatility.

A breakout above or below the bands suggests a strong trend.

Traders often use this in conjunction with the Moving Average or RSI for more accurate predictions.

Helps identify potential reversal or continuation points.

4. MACD: A Powerful Indicator for Forex Timing

The Moving Average Convergence Divergence (MACD) indicator helps traders identify momentum changes and potential trend reversals.

The MACD consists of two lines: the MACD line and the signal line.

When the MACD crosses above the signal line, it signals a buy opportunity.

When the MACD crosses below the signal line, it signals a sell opportunity.

Traders often use it with the RSI for additional confirmation.

Useful for both short-term and long-term trading strategies.

5. Using Fibonacci Retracement for Precise Trade Entries

Fibonacci Retracement levels are widely used to identify potential support and resistance zones.

Key levels include 23.6%, 38.2%, 50%, 61.8%, and 100%.

Traders look for price retracements to these levels before entering trades in the direction of the trend.

Works well with other indicators like RSI or MACD for confirmation.

| Fibonacci Level | Meaning | Typical Use Case | Risk Factor |

|---|---|---|---|

| 23.6% | Minor retracement | Minor price corrections | Low |

| 38.2% | Strong retracement | Strong pullbacks within a trend | Moderate |

| 50% | Neutral zone | Can indicate reversal or continuation | Moderate |

| 61.8% | Key level | Often a strong reversal point | High |

6. Stochastic Oscillator: Timing Forex Trades in Overbought/Oversold Markets

The Stochastic Oscillator compares a closing price to the price range over a set period.

Values above 80 indicate overbought, and below 20 indicate oversold conditions.

Helps identify potential reversals when used with other tools like the Bollinger Bands or RSI.

It is a versatile indicator that works well in trending and ranging markets.

Technical indicators like Moving Averages, RSI, and Bollinger Bands are essential tools for timing Forex trades. By understanding how to interpret these indicators, traders can gain valuable insights into market trends and make more informed trading decisions.

Trading Platforms and Tools to Help You Time Your Trades

When timing your Forex trades, the right tools and platforms are essential. Trading platforms like MetaTrader 4 or cTrader provide essential tools to help you analyze market trends, track currency pairs, and make informed decisions.

1. Overview of Popular Forex Trading Platforms

Explore the key platforms traders use to time their trades effectively.

MetaTrader 4 (MT4): A leading platform known for its flexibility in customizing indicators, automated trading, and a variety of technical tools like the Moving Average and RSI.

MetaTrader 5 (MT5): An upgraded version of MT4, offering additional features such as more timeframes and improved charting options. It supports both Forex and other financial instruments, like stocks.

cTrader: Known for its intuitive interface, high-speed order execution, and advanced charting tools. Perfect for traders who rely heavily on technical indicators like Fibonacci Retracement or Bollinger Bands.

TradingView: A browser-based platform, offering cloud-based charting with a variety of trading indicators and live market analysis for multiple asset types, including Forex and cryptocurrencies.

2. Key Tools to Optimize Your Forex Trading Timing

These tools help traders make better decisions by identifying trends and key market signals.

Technical Indicators:

Moving Average (MA): Essential for identifying trends over a specific period.

RSI (Relative Strength Index): Helps spot overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Offers insights into momentum and potential reversals.

Bollinger Bands: Helps identify volatility and price levels.

Economic Calendars: Track economic indicators such as GDP, Inflation, Interest Rates, and Nonfarm Payrolls. They alert you to news events that may impact currency pairs like USD/JPY or EUR/USD.

Automated Trading Tools: Platforms like MetaTrader 4 and cTrader offer automated trading tools, such as Expert Advisors (EAs), that help execute trades at optimal times without manual intervention.

3. How to Use Trading Platforms to Identify the Best Times for Trades

Using the right platform helps identify when the market is most volatile, which is crucial for maximizing potential profits.

Forex trading requires precision and timely entry. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) come with charting tools and custom indicators, which can be tailored to your strategy. These platforms allow you to track live data of currency pairs like EUR/USD and GBP/USD, making it easier to spot trends and determine the best time to enter or exit trades.

For instance, RSI is a powerful tool on MT4 that can identify whether a currency pair like USD/CHF is in overbought or oversold conditions, signaling an ideal entry point. Additionally, platforms like cTrader have high-frequency trade execution capabilities, which are useful during peak market hours when price movements are more volatile.

Economic news also plays a critical role in determining the best time to trade. Using a platform like TradingView, you can access real-time news feeds and economic calendars. If an event like Nonfarm Payrolls is due, it can significantly impact currency pairs like USD/JPY, making it the right moment to enter the market for potential volatility.

4. Comparative Table of Major Trading Platforms for Forex Timing

| Platform | Key Features | Trading Tools | Popular Currency Pairs | Economic Indicator Integration |

|---|---|---|---|---|

| MetaTrader 4 | Customizable indicators, automated trading | RSI, Moving Average, MACD | EUR/USD, GBP/USD, USD/JPY | Yes, integrates with news feeds |

| MetaTrader 5 | More timeframes, expanded charting tools | Fibonacci, ADX, Ichimoku | EUR/USD, USD/CHF, EUR/JPY | Yes, advanced economic data |

| cTrader | Fast order execution, advanced charts | Stochastic, Bollinger Bands | AUD/USD, EUR/GBP, USD/CAD | Yes, real-time news alerts |

| TradingView | Cloud-based, social trading features | RSI, Moving Average, ATR | EUR/USD, GBP/JPY, USD/CHF | Yes, integrates economic data |

These tools and platforms make it possible to spot optimal trade timings, ensuring that your trades are well-positioned to capitalize on market movements. Whether you are trading EUR/USD or USD/CHF, the key is to rely on reliable platforms that provide timely data and analysis.

Conclusion:

In conclusion, effectively timing your Forex trades requires a deep understanding of market hours, trading platforms, and key tools. By leveraging platforms like MetaTrader 4, cTrader, and TradingView, along with using technical indicators such as the Moving Average, RSI, and MACD, you can enhance your trading strategy. Integrating economic indicators like Nonfarm Payrolls and CPI further helps in making informed decisions. Ultimately, using the right platforms and tools can make all the difference in maximizing your trading success.