Table of contents

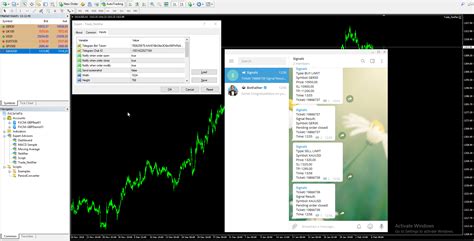

Trading success often hinges on timely and accurate information, making real-time alerts a critical component of any trader's toolkit. By leveraging MQL4 Telegram integration, traders can automate notifications for trading signals, price changes, and market updates directly to their Telegram app. This combination of MQL4's powerful scripting capabilities and Telegram's robust messaging platform enables seamless communication of vital trading data. Whether you're managing multiple currency pairs or fine-tuning a technical strategy, learning how to use MQL4 for Telegram alerts can streamline your decision-making process and enhance your trading performance.

Setting Up MQL4 for Telegram Notifications

Setting up MQL4 for Telegram alerts combines MQL4 programming and Telegram API integration to deliver real-time trading signals. This guide simplifies the process for traders and developers.

Introduction to MQL4 Programming for Notifications

MQL4 programming is at the heart of MetaTrader 4 (MT4) automation. Notifications ensure traders are informed in real-time without monitoring screens constantly.

Key points:

MQL4 Code allows integration with external systems like Telegram.

Scripts in MQL4 are tailored to send notifications.

Notifications improve technical analysis efficiency by automating price alerts and signal alerts.

Understanding Telegram API for Developers

The Telegram API is a developer-friendly interface that powers automation. It connects trading alerts to Telegram through structured communication protocols.

Telegram API Key Features for Trading Alerts

| Feature | Description | Use in Trading |

|---|---|---|

| BotFather Setup | Telegram bot creation and API token generation. | Initiates the connection between MT4 and Telegram. |

| SendMessage Endpoint | API method to send messages to chats. | Delivers real-time alerts (e.g., Buy/Sell signals). |

| Rate Limits | Restrictions on API requests per second. | Prevents overloading from frequent alerts. |

| Webhook Integration | Automatic updates from Telegram via webhooks. | Ensures timely trading notifications. |

| Multi-format Messaging | Text, images, and inline buttons supported. | Enhances signal readability with detailed formats. |

Creating a Telegram Bot for Alerting

Open Telegram and search for BotFather.

Use the

/newbotcommand to create a bot.Follow prompts to name the bot and generate an API token.

Save the token for later integration with MQL4.

Integrating MQL4 with Telegram API

Step-by-step guide:

Open MT4 and access the MQL4 Editor.

Write a Custom Script to make HTTP requests.

Use the Telegram API’s SendMessage endpoint in the script.

Add authentication using the bot’s API token.

Test the integration by sending a test message to your bot.

Testing the Notification System

A successful integration demands rigorous testing to avoid missed alerts.

Use dummy signals for test alerts.

Check for real-time delivery of messages in the Telegram app.

Debug common issues like incorrect HTTP requests or API token errors.

Optimize settings for frequent price alerts during volatile trading periods.

Automating Trading Signals with MQL4

Integrating MQL4 programming into trading strategies enables traders to automate Buy/Sell signals, making Telegram notifications a powerful tool for real-time Forex Trading updates.

Creating an Expert Advisor for Signals

Expert Advisors (EAs) are the backbone of MQL4 automation, enabling seamless execution of trading strategies.

To develop an EA for Telegram integration:

Use MQL4’s

OnTickfunction to monitor price movements.Program conditional logic for Buy Signals or Sell Signals using indicators like RSI or MACD.

Add functions to trigger Telegram API calls for real-time alerts.

Key tips:

Test EA logic in MetaTrader 4.

Avoid excessive alerts by using thresholds like Price Alerts or Market Volatility indicators.

Key Indicators for Signal Generation

Using precise indicators in automated trading helps generate accurate signals. For instance, Moving Averages are ideal for identifying trends, while Stochastic Oscillators highlight overbought or oversold zones. Combining indicators like RSI and MACD improves accuracy by blending momentum analysis with trend-following tools.

Custom Indicators in MQL4 can also be created to meet specific trading strategy needs. These indicators help in refining Entry Points and Exit Points for trades, ensuring better Trading Strategy alignment with real-time Market Data.

Filtering Alerts for Noise Reduction

Automated systems can generate excessive alerts, leading to noise. Filtering mechanisms help ensure meaningful notifications:

| Filter Type | Implementation | Impact on Alerts |

|---|---|---|

| Indicator Thresholds | Set RSI above 70 or below 30 for alerts. | Reduces false-positive overbought/sold alerts. |

| Volatility Filters | Monitor Bollinger Bands for narrow or wide bands. | Focuses alerts during high-volatility periods. |

| Time-based Filters | Send alerts only during active Forex trading sessions. | Limits unnecessary notifications during quiet markets. |

| Currency Pair Selection | Track specific pairs like EUR/USD or GBP/USD. | Keeps alerts relevant to chosen strategies. |

By implementing such filters, traders can focus on actionable alerts while avoiding distraction.

Linking Alerts to Specific Currency Pairs

Currency Pairs like EUR/USD and GBP/JPY require targeted signals to enhance relevance.

To link MQL4 alerts to specific pairs:

Use

Symbol()function in MQL4 to identify the active chart’s currency pair.Programmatically adjust signal thresholds based on the pair’s Market Volatility.

Include the pair’s name in Telegram Notifications for clarity.

Benefits:

Ensures alerts align with the trader’s preferred Financial Instruments.

Simplifies monitoring during multi-pair Forex Trading.

By following these strategies, traders can automate signal generation using MQL4 while leveraging Telegram for efficient, filtered notifications, ensuring seamless Forex Trading experiences.

Advanced Telegram Notification Strategies

Unlock the full potential of Telegram Notifications for trading with MQL4 Programming, from crafting versatile Trading Alerts to optimizing real-time Telegram Bot functionalities.

Differentiating Notification Types (Price, Signals, News)

Price Alerts

Triggered when market data hits predefined thresholds.

Examples: Crossing resistance/support levels.

Trading Signal Alerts

Buy/Sell Signals based on technical indicators (e.g., RSI or MACD).

Includes critical details like entry/exit points and Stop Loss.

News Alerts

Notifications for economic events impacting the Forex market.

Key for staying ahead of market volatility.

Using Telegram Groups and Channels for Alerts

Telegram Groups: Ideal for interactive discussion among traders.

Share Buy/Sell Signals with group members.

Manage roles for safe collaboration.

Telegram Channels: Broadcast alerts to a broader audience.

Example: Sending curated Market Data and trading strategies.

Use pinned messages for key updates.

Customizing Notifications with Metadata

Enhance clarity by adding technical analysis metadata to alerts:

| Metadata Type | Example Details | Importance |

|---|---|---|

| Entry/Exit Points | Buy @ 1.1000, Sell @ 1.1050 | Precise execution for trading strategies. |

| Stop Loss/Take Profit | SL: 1.0950, TP: 1.1100 | Risk management and profit booking. |

| Technical Indicators | RSI = 70 (Overbought), MACD Divergence | Ensures actionable trading insights. |

| Market Volatility | High (FOMC Meeting Impact) | Guides risk-adjusted trade decisions. |

Real-time Market Updates through Bots

Pull real-time data from APIs (price quotes, economic events).

Customize triggers for rapid alerts on Currency Pair movements.

Example: Sending updates on EUR/USD volatility spikes.

Scheduling Alerts Based on Trading Hours

Optimize notifications around Forex Trading sessions (Asian, European, US).

Program alerts for session-specific events like market openings.

Example: Receive updates on London session breakout strategies.

Analyzing Performance of Telegram Alerts

Evaluate Accuracy

Match alerts with actual Trading Signals (Buy/Sell).

Track execution timing in MetaTrader 4 logs.

Optimize Delivery

Address delays in Telegram API integration.

Adjust signal triggers based on backtested MQL4 Code.

Enhance Usability

Collect feedback from users in Telegram Groups.

Refine message formats for clarity.

Securing MQL4 and Telegram Integrations

Protecting the integration of MQL4 with Telegram is critical for maintaining reliable alerts and secure access to trading signals. This ensures robust and uninterrupted automated trading workflows.

Protecting API Tokens and Keys

Use Secure Storage Solutions

Store API tokens in encrypted files or secure password managers.

Avoid hardcoding sensitive keys directly into MQL4 code.

Restrict Access Permissions

Limit API token usage to specific IPs or devices.

Implement multi-factor authentication for Telegram API accounts.

Rotate API Keys Regularly

Change tokens periodically to prevent unauthorized access.

Automate token rotation in trading systems for added security.

Monitor Token Usage

Use Telegram Bot API logs to detect unusual activity.

Track failed API calls to identify potential breaches.

Monitoring System Vulnerabilities

Identifying and addressing vulnerabilities in your MQL4 and Telegram setup is essential for ensuring long-term system integrity. Vulnerabilities may arise from poorly written code, unmonitored network activity, or outdated libraries.

For instance, insecure HTTP requests in MQL4 can expose sensitive information. By leveraging encrypted HTTPS protocols, you can safeguard the transmission of data to the Telegram Bot API. Regularly review error logs in MetaTrader 4 to identify anomalies, such as frequent disconnects or failed alert transmissions, which could indicate deeper problems.

Additionally, automate system audits. By using tools like automated code analyzers and Telegram bot activity trackers, vulnerabilities can be detected early. Keep your MetaTrader 4 platform and its libraries updated to the latest versions to mitigate known risks.

Ensuring Compliance with Telegram API Policies

Understand Rate Limits

Telegram API enforces message rate limits to prevent spam.

Adhere to the limit of 20 messages per minute per bot.

Avoid Prohibited Actions

Do not send unsolicited bulk messages.

Ensure bots comply with local regulations on data privacy.

Optimize API Calls for Efficiency

Use batch processing for messages to minimize API usage.

Cache reusable data to reduce redundant API calls.

Plan for Service Downtime

Implement fallback mechanisms like email alerts for critical messages.

Regularly monitor Telegram API status updates.

Ensuring Compliance with Telegram API Policies

| Policy Area | Compliance Tips | Consequences of Non-Compliance |

|---|---|---|

| Rate Limits | Limit bots to 20 messages per minute per user. | Bot suspension or delays in message delivery. |

| Message Content | Avoid sensitive or prohibited data in messages. | Account bans or reputational damage. |

| Privacy Regulations | Encrypt user data and avoid storing it unnecessarily. | Legal penalties for data misuse. |

| API Token Security | Rotate tokens regularly and store them securely. | Unauthorized access to bot functions. |

| API Uptime Management | Monitor service updates and implement failover systems. | Interruptions in alert delivery. |

Enhancing Trading Strategies with Alerts

Integrating MQL4 with Telegram enhances trading workflows by delivering precise, real-time alerts. This cluster explores strategies to refine these alerts for trading success, from workflows to backtesting and collaborative enhancements.

Integrating Alerts into Trading Workflows

Combine Price Alerts with Entry Point Signals for precise trade execution.

Leverage Telegram Notifications for Stop Loss and Take Profit updates.

Synchronize alerts across devices using the Telegram Bot API, ensuring no trading opportunity is missed.

Adjust alerts based on market volatility and currency pair characteristics.

Use MetaTrader 4 Custom Indicators to automate updates during peak Forex Trading hours.

Refining Alerts with Backtesting Data

Utilizing historical data strengthens alert accuracy and reliability.

Analyze Buy Signals and Sell Signals triggered by custom strategies.

Compare performance of RSI and Bollinger Bands for signal validation.

Optimize alert settings using market data from past trading sessions.

Refine conditions for real-time alerts to minimize false signals.

Leveraging News and Event Alerts

Economic news and events significantly influence trading decisions.

Use MQL4 to parse economic calendar data and create News Alerts.

Program Telegram Bots to notify before market-moving events, like interest rate announcements.

Pair event alerts with Technical Analysis for an edge in volatile conditions.

Categorize alerts by currency pairs to focus on relevant financial instruments.

Sample Event Alert Categorization

| Alert Type | Trigger Event | Currency Pair | Impact Level | Notification Format |

|---|---|---|---|---|

| Economic Data Release | Non-Farm Payrolls (NFP) | USD/EUR | High | Direct Telegram Message |

| Central Bank Decision | Fed Interest Rate Hike | USD/JPY | Medium | Group Channel Announcement |

| Market Volatility Alert | Sudden Spike in Price | GBP/USD | High | Real-time Bot Notification |

| Event Risk Warning | Geopolitical Developments | AUD/USD | Variable | News Update in Telegram Group |

Scalability: From Individual to Group Strategies

Share alerts via Telegram Groups, fostering team-based strategies.

Employ permissions in Telegram Channels to maintain alert integrity.

Use MQL4 Libraries to distribute standardized Trading Signals across multiple bots.

Design bots that tailor alerts to group-specific Forex Trading needs.

Refining MQL4-Telegram alerts transforms them into strategic tools for traders. Through workflows, backtesting, news integration, and scalability, these methods create a robust framework for consistent trading success. By applying these approaches, traders unlock higher precision and teamwork in their trading endeavors.

Conclusion

Integrating MQL4 with Telegram for trading alerts is a transformative approach for modern traders seeking real-time updates and increased efficiency. By leveraging Expert Advisors, Telegram Bots, and tailored trading signals, traders can automate their workflows, make timely decisions, and remain competitive in the ever-evolving Forex market. Security and customization ensure this integration is not only powerful but also reliable. With these tools in place, you’re well-equipped to automate alerts, refine your strategies, and gain an edge in the fast-paced trading environment.

MQL4 is a programming language designed for MetaTrader 4. It enables traders to create Expert Advisors and scripts that automate trading tasks. For Telegram alerts, MQL4 can be programmed to send real-time trading signals, like buy or sell alerts, directly to your Telegram account.

Setting up a Telegram bot involves:

This setup allows you to send customized notifications such as price alerts or market updates.

Using BotFather to create a new bot.

Generating an API token.

Configuring the bot in MQL4 using HTTP requests.

Yes, MQL4 allows you to program alerts based on popular indicators such as:

By coding the logic, you can send Telegram notifications when certain indicator thresholds are met.

RSI (Relative Strength Index) for overbought/oversold levels.

MACD for momentum changes and trend reversals.

Yes, but it requires precautions:

Protect your Telegram API token to avoid unauthorized access.

Regularly monitor your system for vulnerabilities.

Follow Telegram’s API guidelines to maintain secure communication between MQL4 and Telegram.

You can automate a variety of signals, including:

Buy and sell signals based on specific market conditions.

Entry and exit points for your trades.

Stop-loss and take-profit alerts to manage risk effectively.

News or event-based alerts for market volatility updates.

Some limitations include:

Telegram API rate limits, which restrict the frequency of messages.

Complexity in coding, especially for beginners in MQL4 programming.

Reliance on stable internet connections to ensure timely alerts.

Yes, you can customize alerts for specific currency pairs. For example, you can configure notifications for EUR/USD, GBP/USD, or any pair you frequently trade, and include additional details like stop-loss levels or market conditions.

Telegram notifications improve efficiency by:

These features ensure you stay informed and responsive in dynamic trading environments.

Delivering real-time alerts, enabling faster decision-making.

Consolidating critical market data into actionable updates.

Reducing manual monitoring by automating key trading strategies.