Forex scalping on daily charts is a dynamic trading strategy that requires precision, quick decision-making, and a deep understanding of market conditions. By learning how to play forex scalp effectively, traders can capitalize on small price movements within the daily timeframe, leveraging volatility to achieve consistent profits. This method combines technical indicators, strategic execution, and disciplined risk management to navigate the complexities of currency pairs like EUR/USD or GBP/USD.

Core Principles of Forex Scalping

Forex scalping on daily charts requires precision, liquidity, and volatility awareness. Explore essential strategies, tools, and techniques to optimize trades with small profits and fast execution.

Understanding Scalping: Fast Trades, Small Profits

Forex scalping is a trading strategy where traders capitalize on small price movements over a short period. This approach aims for incremental profits by executing multiple trades daily. Scalping on daily charts combines broader market analysis with short-term execution.

Quick Trades: Involves entering and exiting positions within minutes, ideal for capturing minor fluctuations.

Small Profits Per Trade: The focus is on consistency rather than single large gains.

Why Daily Charts? These charts provide a stable overview of trends while allowing strategic adjustments for quick trades.

The Importance of Volatility and Liquidity in Scalping

Volatility and liquidity significantly impact forex scalping effectiveness:

Volatility:

High volatility increases price movements, creating more trading opportunities.

Ideal during market overlaps, such as the London-New York session.

Liquidity:

Deep liquidity ensures smoother trade execution with minimal slippage.

Major pairs like EUR/USD and GBP/USD offer superior liquidity.

Volatility-Liquidity Balance:

Excessive volatility can lead to erratic price movements.

Moderate volatility coupled with high liquidity is optimal for scalping.

Key Currency Pairs for Scalping

Currency pairs with high liquidity and low spreads are favored for scalping. Here’s a detailed comparison:

| Currency Pair | Spread (Average) | Liquidity | Scalping Suitability | Market Overlap Activity |

|---|---|---|---|---|

| EUR/USD | 0.5-1 pip | High | Excellent | Active during London-New York |

| USD/JPY | 1-2 pips | High | Very Good | Peaks during Tokyo-London |

| GBP/USD | 1-2 pips | High | Very Good | Strong in London-New York |

| USD/CHF | 2-3 pips | Moderate | Good | Stable in London session |

These pairs provide a mix of tight spreads and steady price action, enabling efficient scalping strategies.

Time Frame Considerations for Scalping

Scalping requires selecting the right time frames to balance precision and information depth:

1-Minute Charts:

Ideal for pinpointing entry and exit points.

Provides detailed price action but requires intense focus.

5-Minute Charts:

Offers a broader view of short-term trends.

Helps reduce noise from rapid price fluctuations.

Daily Chart Integration:

Acts as a macro-level guide to confirm trends and support decision-making for scalping trades.

By combining 1-minute and 5-minute charts with daily trend analysis, traders can effectively time their trades while minimizing risks.

Mastering forex scalping on daily charts involves understanding market dynamics, selecting optimal currency pairs, and leveraging appropriate time frames. Combining technical precision with strategic execution ensures consistent profitability in the fast-paced world of scalping.

Technical Indicators for Daily Scalping

Technical indicators are vital tools for forex scalpers, enabling precise analysis of market conditions, trend direction, and optimal entry and exit points. Scalping with indicators like Moving Averages, RSI, and Bollinger Bands ensures traders capitalize on daily chart movements.

1: Moving Averages: Identifying Trends for Daily Scalping

Moving Averages simplify price trends, helping scalpers make quick decisions.

Simple Moving Average (SMA): Calculates the average closing price over a defined period, such as 10 or 20 days, offering a clear view of the trend.

Exponential Moving Average (EMA): Places greater weight on recent prices, making it more responsive to short-term price movements—a critical factor in scalping.

Application in Scalping:

Use crossovers between fast and slow EMAs (e.g., 5-day EMA crossing above the 20-day EMA) to identify potential trade setups.

Combine with oscillators for confirmation.

2: RSI and Stochastic Oscillators: Overbought and Oversold Conditions

These oscillators are essential for identifying trade opportunities in scalping:

Relative Strength Index (RSI):

Measures price momentum and identifies overbought (>70) or oversold (<30) levels.

Example: RSI drops below 30, signaling a potential buying opportunity.

Stochastic Oscillator:

Compares closing prices to the price range over a specific period.

Scalpers look for %K crossing above %D for buy signals.

Combined Usage:

Confirm entry points with both indicators.

Avoid signals during low liquidity hours (e.g., after market closures).

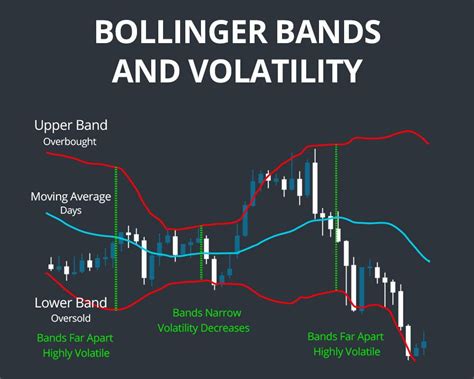

3: Bollinger Bands: Detecting Breakouts and Swings

Bollinger Bands measure volatility, helping traders anticipate price swings:

Key Features:

The middle band is the SMA, while the upper and lower bands represent standard deviations.

Bands widen during high volatility and contract during consolidation.

Scalping Application:

Look for price touching or breaking the upper/lower bands as potential reversal signals.

Combine with RSI to confirm trade timing.

Bollinger Bands Scalping Guide

| Market Condition | Band Behavior | Scalping Strategy |

|---|---|---|

| High Volatility | Bands widen | Look for breakouts and quick reversals |

| Low Volatility | Bands contract | Wait for a breakout before entering trades |

| Trending Market | Price rides along a band | Use trailing stop-loss to lock in profits |

| Range-Bound Market | Price oscillates | Trade reversals at upper and lower bands |

4: MACD: Trend Confirmation for Scalping

The MACD (Moving Average Convergence Divergence) is indispensable for identifying momentum shifts:

Core Components:

The MACD line is the difference between the 12-EMA and 26-EMA.

Signal line (9-EMA of the MACD) helps confirm trends.

Scalping Approach:

Look for bullish crossovers (MACD above the signal line) for buy signals.

Bearish crossovers signal selling opportunities.

Confirm with Bollinger Bands or RSI for accuracy.

5: Fibonacci Retracements: Pinpointing Scalping Entry Levels

Fibonacci retracements aid scalpers in determining key levels for entries and exits:

How It Works:

Identify a recent high and low on the daily chart.

Apply Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, 100%) to locate retracement zones.

Practical Example:

A downtrend on the EUR/USD sees a pullback to the 61.8% level. This is an ideal point to enter a short position.

Scalping Tip:

Combine retracements with MACD or RSI to confirm reversals at these levels.

Each technical indicator enhances scalping on daily charts by providing actionable insights. Moving Averages highlight trends, oscillators confirm entry points, and tools like Bollinger Bands and Fibonacci Retracements refine timing and precision. Together, they form a cohesive toolkit for scalpers aiming to master the forex market.

Risk Management in Forex Scalping

Effective risk management is essential for consistent profits in forex scalping. By mastering position sizing, implementing stop-loss and take-profit orders, and understanding the risk-reward ratio, traders can secure trades and optimize their strategies.

Position Sizing: Managing Capital for Scalping

Base Calculations on Account Size:

Determine the percentage of your trading capital you are willing to risk (commonly 1-2% per trade).

Use this risk amount to calculate the lot size.

Adapt to Currency Pair Volatility:

Higher volatility pairs like GBP/USD may require smaller position sizes due to increased risk.

Less volatile pairs like EUR/USD allow for larger positions.

Leverage and Margin:

Account for the leverage offered by trading platforms like MetaTrader 4 and cTrader.

Ensure margin requirements align with your position sizing.

Position Sizing for Different Pairs

| Currency Pair | Account Size ($) | Risk (%) | Stop-Loss (Pips) | Lot Size |

|---|---|---|---|---|

| EUR/USD | 10,000 | 2% | 10 | 0.2 |

| GBP/USD | 10,000 | 1% | 15 | 0.13 |

| USD/JPY | 10,000 | 1.5% | 12 | 0.17 |

Stop Loss and Take Profit Orders: Securing Trades

Stop-loss and take-profit orders are vital for protecting capital and locking in profits:

Stop-Loss Orders:

Automatically closes trades when the price moves against the trader.

Prevents excessive losses due to sudden market volatility.

Take-Profit Orders:

Closes trades at a predefined profit level.

Ensures gains are not eroded by market reversals.

Strategic Placement:

Use technical indicators like Bollinger Bands or Fibonacci Retracement to determine optimal levels.

Align stop-loss and take-profit distances with the risk-reward ratio for consistency.

Risk-Reward Ratio: Calculating Scalping Efficiency

The risk-reward ratio evaluates potential profits relative to losses, helping traders make informed decisions:

Common Ratios:

A 1:2 ratio implies risking $1 to gain $2, which is ideal for scalping.

Higher ratios, like 1:3, reduce the need for frequent winning trades.

Practical Application:

Use historical price data on TradingView to analyze scalping success rates.

Combine with indicators such as Moving Averages and RSI for better predictive accuracy.

Key Benefits:

Ensures long-term profitability even with a lower win rate.

Encourages disciplined trade execution by limiting emotional decisions.

Mastering risk management in forex scalping strengthens trading strategies, minimizes losses, and builds confidence. By implementing proper position sizing, setting effective stop-loss and take-profit orders, and leveraging the risk-reward ratio, traders can optimize their profitability and safeguard their capital.

Scalping Strategies on Popular Trading Platforms

Forex scalping leverages speed, precision, and the right tools. Popular platforms like MetaTrader and cTrader empower traders with features such as custom indicators, automation, and advanced visualization, essential for scalping success.

Scalping with MetaTrader 4

MetaTrader 4 (MT4) remains a favorite for scalpers due to its simplicity and efficiency.

One-Click Trading: Perfect for scalping, it reduces order execution time.

Custom Indicators: Tailored tools like Moving Average and RSI enable traders to refine strategies.

Low Latency Execution: Ensures immediate trade placement during volatile market conditions.

Widely Supported Brokers: Compatibility with top brokers offering low spreads for EUR/USD and GBP/USD pairs.

MetaTrader 5: Advanced Tools for Successful Scalping

MetaTrader 5 (MT5) advances the scalping experience with its powerful capabilities.

Multi-Timeframe Analysis: Allows simultaneous viewing of 1-minute and daily charts for context.

Depth of Market (DOM): Offers insight into liquidity, aiding precise entry and exit points.

Faster Execution: Ideal for scalping volatile markets like USD/ZAR and AUD/USD.

Built-In Economic Calendar: Helps incorporate news trading into scalping strategies.

cTrader: Leverage Scalping-Oriented Features

cTrader caters specifically to scalping with its advanced tools:

Customizable Chart Layouts: Traders can set up multi-chart displays to monitor trends.

Fast Execution Speed: Beneficial during periods of high liquidity.

Comprehensive Technical Indicators: Includes Bollinger Bands and Parabolic SAR for precise trade identification.

Automated Trading: Supports scalping robots optimized for high-frequency trades.

TradingView: Leverage Cutting-Edge Visualization Technology for Scalping

TradingView blends innovation with accessibility, making it a scalper’s dream.

Interactive and responsive charts with easy annotation.

Community-shared strategies improve scalping insights for currency pairs like USD/JPY.

Extensive library of indicators like MACD, Stochastic Oscillator, and Fibonacci Retracement.

Cloud-based functionality enables seamless access across devices.

Mobile Scalping: Pros and Cons of Trading Apps

Scalping via mobile apps offers flexibility but has trade-offs:

Pros:

Real-time price alerts for quick decisions.

Mobile access to platforms like MT4 and TradingView for scalping EUR/USD.

Intuitive interfaces and one-touch execution.

Cons:

Smaller screens hinder detailed analysis of Bollinger Bands and ADX.

Limited processing power may slow execution during peak market volatility.

Increased risk of errors due to environmental distractions.

Custom Scripts and Robots for Scalping

Automation revolutionizes scalping by reducing human error and maximizing efficiency.

| Feature | Benefit | Example Use Case |

|---|---|---|

| Custom Indicators | Fine-tune strategies | Detecting breakouts in GBP/USD using RSI |

| Scalping Robots | Execute trades automatically | High-frequency trades during volatile news |

| Backtesting Capabilities | Validate strategies | Test Bollinger Band-based scalping on USD/CHF |

| Script Automation | Streamline repetitive tasks | Setting stop-loss orders across multiple trades |

Automation tools ensure consistency, especially during high-volatility sessions like London–New York overlaps.

Popular platforms like MT4, MT5, cTrader, and TradingView cater to scalping with tailored tools and features. From mobile flexibility to automated robots, scalpers have diverse options to execute precise, fast trades, ensuring they remain competitive in ever-changing forex markets.

Advanced Scalping Techniques and Strategies

Advanced forex scalping techniques integrate high-precision strategies and mental discipline. Leveraging daily chart insights, traders capitalize on volatility peaks and news events while staying disciplined for consistent performance.

1. Trading the News with the Daily Chart

Explore how economic announcements create scalping opportunities.

Economic news like NFP (Non-Farm Payrolls), interest rate decisions, or inflation reports often cause high volatility, presenting scalping opportunities.

Focus on currency pairs such as EUR/USD, USD/JPY, and GBP/USD during news events, as they typically have tighter spreads and higher liquidity.

Use Fibonacci Retracement levels and Moving Averages to identify optimal entry points during post-news retracements.

Time frames like 1-minute or 5-minute charts are ideal for detecting quick price reactions.

Apply a Stop-Loss Order and a tight Risk-Reward Ratio to minimize risks during sudden market swings.

2. Trend Trading vs. Counter-Trend Scalping

Compare methods of trading with or against the market trend.

Trend Trading:

Align trades with the prevailing trend visible on the daily chart.

Indicators like MACD and ADX can confirm trend strength.

Trade in low-volatility conditions for consistent moves.

Counter-Trend Scalping:

Identify potential reversals using Bollinger Bands or the RSI.

Focus on overbought or oversold zones to execute scalps.

Employ tight stop-losses due to higher risks in counter-trend trades.

| Feature | Trend Trading | Counter-Trend Scalping |

|---|---|---|

| Indicators Used | MACD, ADX | RSI, Bollinger Bands |

| Risk Level | Moderate | High |

| Time Frame | Daily chart for confirmation | 1-minute to 5-minute charts |

| Execution Focus | Low-volatility trends | Volatility spikes or reversals |

| Suitability | Beginner-friendly | Advanced traders |

3. High-Frequency Scalping During Volatility Peaks

Focus on timing trading during the London and New York overlap sessions.

The London-New York overlap (13:00–17:00 UTC) is a prime time for scalping due to increased liquidity and volatility.

Currency pairs like EUR/USD, USD/CHF, and GBP/USD exhibit narrow spreads and significant movement during this period.

Use Stochastic Oscillator to identify short-term entry points during volatility peaks.

Apply Take-Profit Orders for quick exits to secure gains.

Tools like MetaTrader 4 or TradingView enable rapid analysis and execution during peak trading hours.

4. Scalping Psychology: Staying Disciplined in Fast Moving Markets

Emphasis on mental preparation and focus for successful scalping.

Scalping requires unwavering focus to handle rapid decision-making and market fluctuations.

Overcome fear and greed by sticking to pre-set rules for position sizing and stop-loss orders.

Practice mindfulness techniques to maintain calm during intense sessions.

Use demo accounts on platforms like MetaTrader 5 to simulate high-frequency trades and build confidence.

Tip: Journaling trades can help identify psychological triggers affecting trading decisions.

Advanced scalping strategies thrive on leveraging economic news, understanding trends, and mastering volatility peaks. Each technique, when paired with psychological discipline and robust tools, paves the way for precise and profitable trades.

Conclusion

Mastering the art of forex scalping on daily charts requires a blend of precision, strategy, and discipline. By understanding the foundational principles, leveraging powerful technical indicators, and adopting effective risk management practices, traders can navigate the fast-paced world of scalping with confidence. Platforms like MetaTrader 4 and cTrader provide the technological edge needed for execution, while advanced strategies such as news trading and psychological discipline help traders maintain consistency. Whether you’re a seasoned scalper or new to the technique, applying these interconnected strategies ensures adaptability and success in varying market conditions. Embrace this dynamic approach, and turn small, consistent trades into cumulative profits over time.