In the fast-paced world of global finance, mastering diverse investment avenues like stocks, bonds, hedge funds, and forex is more crucial than ever. Forex trading, in particular, stands out as a dynamic and potentially lucrative market, offering unparalleled opportunities in 2025 for those equipped with the right knowledge and strategies. As financial markets continue to evolve, understanding how these instruments interact and leveraging their unique characteristics can give investors a significant edge. This guide delves into the intricacies of forex trading while linking it seamlessly to other key investment areas, empowering you to navigate the complexities of modern markets with confidence.

Foundations of Forex Trading

Discover the foundations of Forex Trading, including currency pairs like EUR/USD and USD/JPY, platforms such as MetaTrader 4, and essential market concepts. Build a strong base for mastering forex.

1: What is Forex Trading?

Forex trading involves buying and selling currency pairs like GBP/USD or AUD/USD in a decentralized global market. The aim is to profit from fluctuating exchange rates. Key features include:

Liquidity – The forex market operates 24/5, ensuring highly liquid trading conditions.

Leverage – Forex brokers provide leverage, allowing traders to control large positions with smaller capital.

Flexibility – Trade major pairs (EUR/USD), minors (NZD/USD), and exotics (USD/ZAR).

2: Understanding the Forex Market Structure

The forex market comprises multiple participants and operates across time zones, ensuring constant activity. Key participants include:

Retail Traders: Individuals trading via online platforms.

Banks and Hedge Funds: Major liquidity providers.

Central Banks: Influence exchange rates through monetary policy.

The market’s decentralized nature facilitates dynamic pricing and allows traders to capitalize on economic shifts, geopolitical events, and central bank policies.

3: Types of Currency Pairs and Their Importance

Currency pairs are classified as major, minor, and exotic. Here's a breakdown:

| Type | Examples | Characteristics |

|---|---|---|

| Major | EUR/USD, USD/JPY | High liquidity, narrow spreads, and substantial trading volume. |

| Minor | GBP/AUD, EUR/NZD | Less liquidity than majors, but still popular among seasoned traders. |

| Exotic | USD/ZAR, EUR/TRY | Higher volatility, wider spreads, and significant risk due to economic or political instability. |

Understanding these categories helps in selecting the right trading strategy, such as Scalping or Trend Following, based on pair characteristics.

4: The Role of Leverage in Forex Trading

Leverage amplifies both potential profits and risks. It allows traders to control large market positions by committing only a fraction of the trade value.

For instance:

A leverage ratio of 1:100 means a trader can control $10,000 with just $100.

While this boosts potential gains, it equally heightens exposure to losses.

Traders must carefully manage risk-reward ratios and maintain margin levels to avoid liquidation.

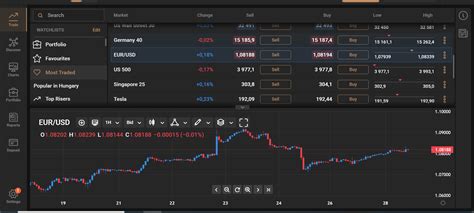

5: Forex Trading Platforms for Beginners

Choosing the right platform is crucial for success. Features of top platforms:

MetaTrader 4 (MT4):

User-friendly interface.

Supports technical indicators like Bollinger Bands and Fibonacci Retracement.

Robust community support.

cTrader:

Superior charting tools.

Advanced order management features.

TradingView:

Comprehensive charting and social trading tools.

Opt for platforms offering demo accounts to practice Scalping and other strategies before trading live.

Advanced Forex Trading Strategies

Forex trading in 2025 demands advanced strategies for navigating market volatility and leveraging opportunities. Explore key approaches like Scalping, Swing Trading, and Trend Following to enhance your trading efficiency and profitability.

1. Exploring Scalping and Day Trading

Scalping:

Focuses on ultra-short-term trades.

Ideal for volatile pairs like USD/ZAR and GBP/USD.

Requires high liquidity and precision timing.

Day Trading:

Positions are closed within the same trading day.

Emphasizes key currency pairs such as EUR/USD and AUD/USD.

Relies heavily on technical indicators like Bollinger Bands and RSI.

Key Tip: Use platforms like MetaTrader 4 for real-time price monitoring.

2. Swing Trading and Position Trading

Swing and position trading cater to traders seeking longer timeframes and sustained trends.

Swing Trading: Targets market reversals using tools like Fibonacci Retracement and Moving Averages.

Position Trading: Focuses on fundamental analysis, such as Central Bank Policy and GDP Growth, to predict long-term trends.

Table: Swing Trading vs. Position Trading

| Aspect | Swing Trading | Position Trading |

|---|---|---|

| Timeframe | Days to weeks | Weeks to months |

| Indicators Used | RSI, Bollinger Bands | Fundamental metrics (e.g., inflation) |

| Currency Pairs | EUR/USD, USD/JPY | GBP/USD, AUD/USD |

| Preferred Strategy | Reversal and breakout patterns | Macro trend analysis |

| Risk Management | Tight stop-loss orders | Wide stop-loss with hedging |

3. Using News Trading for Maximum Impact

News trading involves exploiting market reactions to breaking events:

Sources of News: Economic data (Employment Data, Inflation) and geopolitical updates.

Key Currencies: USD pairs (USD/CAD, USD/CHF) due to their sensitivity to global events.

Tips for Success:

Use TradingView for real-time data visualization.

Pair technical setups like MACD with news alerts for precision.

4. Trend Following Strategies

Trend following is a core strategy leveraging market momentum.

Relies on Moving Averages and Parabolic SAR to identify trends.

Best for pairs like NZD/USD and EUR/GBP, which exhibit consistent trends.

Combine with Grid Trading for optimized entry and exit levels.

Pro Insight: Incorporate risk-reward ratios to evaluate the viability of long-term trades.

Forex trading strategies in 2025 offer diverse opportunities, and mastering them ensures you're ready for any market condition.

Tools and Techniques for Analyzing Forex Markets

Mastering Forex trading requires leveraging powerful tools and techniques. From technical indicators to fundamental analysis, these methods empower traders to make informed decisions in dynamic markets like USD/JPY, EUR/GBP, and USD/ZAR.

1. Technical Indicators for Forex Trading

Technical indicators are essential tools for analyzing market trends and predicting price movements. Here’s a look at some widely used indicators:

Moving Averages (MA): Smooth out price data to identify trends.

MACD (Moving Average Convergence Divergence): Highlights momentum changes and potential reversals.

Bollinger Bands: Determine overbought or oversold market conditions.

RSI (Relative Strength Index): Evaluates the strength and speed of price movements.

Stochastic Oscillator: Compares a specific closing price to a range of prices over time.

2. Fundamental Analysis for Forex Success

Fundamental analysis focuses on understanding economic, financial, and geopolitical factors affecting currencies. Key areas include:

Interest Rates: Determine a currency’s attractiveness for investment.

Inflation: Impacts currency strength by influencing central bank policies.

GDP Growth: Signals economic stability, affecting demand for a currency.

Trade Balances: Affects currency flows and strength.

Central Bank Policies: Drive market sentiment through rate adjustments.

3. Combining Technical and Fundamental Analysis

Integrating both types of analysis offers a holistic view. For instance:

Scenario: A central bank’s dovish stance may weaken USD/JPY, confirmed by bearish MACD signals.

Action: Traders align short-term technical signals with long-term economic trends.

4. Introduction to Fibonacci Retracement

This tool identifies potential reversal levels based on historical price movements.

| Level | Description | Example |

|---|---|---|

| 23.6% | Minor retracement, weak level of support/resistance | A quick retracement in EUR/USD |

| 38.2% | Common reversal point | Trend reversal in USD/CHF |

| 50.0% | Psychological level, not technically Fibonacci | Consolidation in GBP/USD |

| 61.8% | Golden Ratio, strong reversal zone | Major breakout in USD/CAD |

| 78.6% | Deep retracement | Position trades on AUD/USD |

5. Advanced Charting Techniques

Charting platforms like TradingView and MetaTrader 4 empower traders with multi-timeframe analysis. Essential chart types:

Candlestick Charts: Provide detailed price data for each period.

Line Charts: Highlight closing prices for trend identification.

Bar Charts: Show open, high, low, and close prices.

6. Understanding Risk Sentiment and Market Psychology

Market sentiment drives price action, influenced by:

Retail Traders: Reactive to news events.

Institutional Investors: Driven by macroeconomic data.

Hedge Funds: Use leverage and algorithmic strategies.

Traders must interpret sentiment indicators like fear and greed indexes to gauge market conditions.

These tools and techniques integrate seamlessly into Forex trading strategies, ensuring traders can navigate markets like USD/ZAR and EUR/USD confidently. By combining analysis methods, traders build resilience and adaptability.

Risk Management in Forex and Other Markets

Effective risk management is the cornerstone of successful Forex Trading. By mastering tools like Stop-Loss Orders, Risk-Reward Ratios, and Position Sizing, traders can safeguard their capital while maximizing potential returns.

1. Stop-Loss and Take-Profit Orders: A Trader’s Safety Net

Define clear Stop-Loss Orders to limit losses in volatile currency pairs like EUR/USD or GBP/USD.

Use Take-Profit Orders to lock in profits for trades involving trending pairs like USD/JPY.

Key benefits:

Protects against emotional decision-making.

Automates exits for disciplined trading.

Ideal platforms: MetaTrader 5 or TradingView for accurate execution.

2. The Risk-Reward Ratio: Finding the Sweet Spot

The Risk-Reward Ratio (RRR) ensures traders only take trades with a favorable return potential. Here's a breakdown of various RRR setups:

| Risk-Reward Ratio | Suitability | Example Currency Pair | Potential Profit | Potential Loss |

|---|---|---|---|---|

| 1:1 | Conservative, beginner-friendly | EUR/USD | $100 | $100 |

| 1:2 | Balanced, moderate risk | USD/JPY | $200 | $100 |

| 1:3 | Aggressive, high-reward trades | GBP/USD | $300 | $100 |

Insights:

Favor setups of 1:2 or higher to ensure consistent profitability.

Combine with Technical Indicators like Moving Averages for trend validation.

3. Position Sizing and Margin Management

Position sizing is the process of determining how much capital to allocate per trade. Follow these steps:

Calculate risk tolerance as a percentage of account equity (e.g., 1-2%).

Analyze lot size based on the currency pair’s pip value (e.g., USD/CHF vs. USD/ZAR).

Use margin calculators available on platforms like MetaTrader 4.

Key tips:

Avoid over-leveraging; it increases margin calls.

Protect against drawdowns with smaller position sizes during volatile markets.

By mastering Stop-Loss Orders, optimizing the Risk-Reward Ratio, and applying disciplined Position Sizing, traders can minimize risks across forex and other markets. These strategies integrate seamlessly with advanced tools, ensuring sustained growth and resilience in 2025’s dynamic trading landscape.

Cross-Market Interactions: Forex and Beyond

Forex trading is a versatile instrument for investors in 2025, offering crucial insights into stocks, bonds, and hedge funds. Its interconnectedness with other financial markets enhances its strategic value for portfolio diversification.

1. Hedge Funds and Forex: Strategies for Global Investments

Hedge funds integrate forex trading into broader strategies to leverage global economic trends. Key points include:

Diversifying portfolios using currency pairs like EUR/USD and USD/JPY.

Hedging risks against geopolitical uncertainties via News Trading.

Utilizing Carry Trade strategies to benefit from interest rate differentials.

Enhancing returns through high leverage and algorithmic trading on platforms like MetaTrader 5.

2. Stocks vs. Forex: Identifying Market Correlations

The interplay between forex and stocks reveals valuable correlations for traders:

Stock indices like the S&P 500 often reflect trends in major currencies, e.g., USD/CHF during risk-averse periods.

Interest Rates drive both currency and equity valuations, e.g., a Fed rate hike boosts USD and pressures equities.

Forex pairs such as AUD/USD correlate with commodity-dependent stocks due to Australia's resource-driven economy.

3. Bond Yields and Their Influence on Forex Rates

Bond yields directly impact forex markets. For example:

Higher U.S. Treasury yields often strengthen the USD relative to EUR or GBP.

Central bank decisions on Interest Rates influence both bond prices and forex values.

Table: Impact of Bond Yields on Major Currency Pairs

| Bond Yield Change | Currency Pair Impact | Example Scenario |

|---|---|---|

| Rising Yield | Stronger USD | Fed raises rates, boosting USD/JPY |

| Falling Yield | Weaker USD | ECB policy divergence weakens EUR/USD |

| Stable Yield | Range-bound Trading | Limited movement in GBP/USD during market calm |

4. Forex Trading for Diversification in 2025

Investors use forex as a diversification tool:

Retail Traders and Institutional Investors alike benefit from adding forex to portfolios.

Forex pairs like USD/ZAR provide exposure to emerging markets.

Using Position Trading, traders can profit from long-term currency trends tied to global GDP Growth.

By exploring these interactions, traders can maximize profits while mitigating risks, creating a comprehensive and diversified investment strategy.

Conclusion

Mastering stocks, bonds, hedge funds, and Forex trading in 2025 requires a comprehensive understanding of market dynamics, effective strategies, and a proactive approach to risk management. This guide offers a detailed roadmap starting with foundational knowledge of currency pairs and market structure, advancing to sophisticated trading strategies and technical analysis tools, and concluding with insights into managing risk and diversifying portfolios across financial markets.

By following this structured approach, traders and investors can leverage the interconnectedness of markets to optimize their portfolios. Whether you’re a beginner or a seasoned investor, applying these principles will empower you to navigate 2025’s evolving financial landscape with confidence.

Forex Trading involves buying and selling currencies in a global marketplace. It's vital because it allows for international trade, investment, and economic stability, and offers opportunities for traders to profit from currency value fluctuations.

Scalping: Quick trades for small profits.

Swing Trading: Holding positions for days or weeks.

Trend Following: Capitalizing on established market trends.

News Trading: Exploiting market reactions to global events.

The most traded currency pairs, also called major pairs, include:

These pairs have high liquidity and are easier to analyze due to abundant data.

EUR/USD

USD/JPY

GBP/USD

AUD/USD

Technical indicators provide visual insights into price trends and momentum. Examples include:

Using these tools helps traders make data-driven decisions.

Moving Averages: Highlight long-term trends.

MACD: Indicates momentum shifts.

RSI: Detects overbought or oversold conditions.

Fundamental analysis focuses on economic indicators like:

These factors shape currency values and overall market sentiment.

Interest rates set by central banks.

GDP growth and employment data.

Geopolitical events and trade balances.

While Forex trading focuses on currency pairs, stock trading involves equity shares of companies. Forex is more liquid, operates 24/5, and often includes leverage, whereas stock trading is less volatile and offers dividends.

Key techniques include:

Stop-Loss Orders: Automatically closes losing trades.

Take-Profit Orders: Locks in gains.

Position Sizing: Limits risk exposure.

Risk-Reward Ratios: Ensures profitable trades outweigh losses.

MetaTrader 4 (MT4) offers:

User-friendly interface for beginners and pros.

Advanced charting tools for technical analysis.

Access to automated trading via Expert Advisors.

Compatibility across multiple devices, ensuring flexibility.