Managing risk is the cornerstone of success in Forex trading, where market fluctuations can create both opportunities and challenges. Effective risk management strategies not only safeguard your capital but also enable consistent growth, even in the most volatile trading environments. By understanding and implementing techniques such as stop-loss orders, position sizing, and leveraging tools available on platforms like MetaTrader 4, traders can mitigate potential losses and enhance profitability. This guide explores actionable insights into minimizing risks, navigating economic events, and integrating market analysis to build a robust Forex trading strategy tailored to your goals.

Key Risk Management Techniques

Risk management is a cornerstone of Forex trading, ensuring traders can navigate market volatility effectively. Mastering techniques like position sizing, leverage management, and stop-loss orders is critical for success in trading major pairs such as EUR/USD and USD/JPY.

Understanding Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential for limiting losses and securing profits. Here's how to use them effectively:

Stop-Loss Strategies:

Place stops just below support levels for buy positions.

Use technical indicators like Bollinger Bands to guide placement.

Take-Profit Approaches:

Set targets at resistance levels or Fibonacci retracement zones.

Monitor Relative Strength Index (RSI) to avoid exiting trades prematurely.

| Currency Pair | Recommended Stop-Loss (%) | Take-Profit Levels |

|---|---|---|

| EUR/USD | 2% | Resistance at 1.1000 |

| USD/JPY | 1.5% | Fibonacci 61.8% retracement |

| GBP/USD | 3% | Trendline resistance |

Integrating these strategies minimizes emotional decision-making and fosters disciplined trading.

Position Sizing in Forex Trading

Position sizing protects capital by controlling exposure. Follow these principles:

2% Rule: Limit risk to 2% of your trading capital per trade.

Tools:

Leverage online calculators like the “Position Size Calculator” to determine optimal trade size.

Example: If your account balance is $10,000, risk no more than $200 on a trade.

Proper position sizing complements strategies such as trend following, ensuring sustainable growth.

Risk-Reward Ratio: Maximizing Returns

A robust risk-reward ratio helps balance potential profits against losses. Key insights include:

Maintain a minimum ratio of 1:2, risking $50 to gain $100.

Use technical analysis to pinpoint entries and exits.

Currency pairs like EUR/USD and USD/JPY often provide predictable movements, aiding ratio consistency.

Traders with disciplined risk-reward practices find it easier to recover from occasional losses and grow their capital steadily.

Diversification Across Currency Pairs

Diversification reduces risk by spreading exposure. Best practices:

Trade a mix of major pairs, such as GBP/USD and USD/CHF.

Avoid overexposure to correlated pairs like EUR/USD and EUR/JPY.

Monitor market news, such as GDP releases or interest rate decisions, which can impact multiple currencies simultaneously.

Diversification ensures traders can withstand adverse moves in one pair without catastrophic losses.

Managing Leverage and Margin

Leverage amplifies both profits and losses. To manage effectively:

Limit leverage to no more than 1:10 for high-risk trades.

Use platforms like MetaTrader 4 to monitor margin levels and avoid margin calls.

Employ hedging strategies during volatile events, such as Non-Farm Payrolls reports, to protect open positions.

Disciplined leverage usage allows traders to maintain a sustainable trading journey even during periods of heightened volatility.

Leveraging Risk Management Tools

Effective risk management in Forex trading hinges on utilizing the right tools to minimize exposure and optimize profits. This cluster explores critical strategies and trading tools for reducing risk in real-time trading environments.

Stop-loss and Hedging Synergy

Combining stop-loss orders and hedging strategies offers robust protection against unforeseen market fluctuations. Here’s how these two tools work in tandem:

Stop-Loss Orders:

Define a maximum acceptable loss for trades.

Automatically close positions when price moves against your expectations.

Hedging Strategies:

Offset potential losses by opening counter-trades.

Example: If holding a long EUR/USD position, open a short USD/JPY trade during high volatility.

Synergy of Both:

Use stop-loss orders to cap potential losses while leveraging hedging to neutralize risks caused by significant price shifts.

Particularly effective during high-impact economic events like Non-Farm Payrolls or Central Bank Meetings.

Risk Assessment of Trading Platforms

Forex platforms like MetaTrader 4 (MT4) and TradingView provide a wealth of features to assess and mitigate trading risks in real-time.

MetaTrader 4:

Stop-Loss Automation: Set stop-losses directly while placing trades.

Custom Indicators: Use MACD, Fibonacci Retracement, or Bollinger Bands to analyze trends and volatility.

Trailing Stops: Adjust stop-loss levels as profits grow.

TradingView:

Risk Calculators: Calculate position sizes based on account equity and risk tolerance.

Volatility Heatmaps: Identify highly volatile currency pairs such as EUR/JPY and USD/CHF.

Social Analytics: Leverage community sentiment for better decision-making.

Comparing MetaTrader 4 and TradingView for Risk Management

| Feature | MetaTrader 4 | TradingView |

|---|---|---|

| Stop-Loss Automation | Yes | No |

| Custom Indicators | MACD, RSI, Bollinger Bands | Ichimoku Cloud, Fibonacci |

| Social Analytics | No | Yes |

| Risk Calculators | Limited | Advanced |

Market Volatility Alerts

Volatility alerts are essential for managing risk effectively in Forex trading. Traders can use indicators like Bollinger Bands and ATR to detect and respond to market volatility.

Bollinger Bands:

Identify price trends and breakout points.

Useful for trading pairs such as GBP/USD or AUD/USD during news events.

Average True Range (ATR):

Measures market volatility to set stop-loss and take-profit levels.

Helps reduce exposure during volatile sessions, such as Interest Rate Decisions.

Practical Application:

Set alerts when Bollinger Bands contract, signaling low volatility (potential breakout).

Use ATR to adjust position sizes for volatile instruments like USD/CAD.

Economic Events and Their Impact

Economic events significantly influence Forex trading by driving market volatility and shaping trading strategies. Understanding how these events impact currency pairs like EUR/USD and USD/JPY is essential for effective risk management and profitable trading decisions.

Understanding Interest Rate Decisions

Interest rate decisions by central banks like the Federal Reserve and the European Central Bank (ECB) play a pivotal role in Forex markets.

Impact on Major Pairs:

EUR/USD: A hike in US interest rates strengthens the USD, causing EUR/USD to decline.

USD/JPY: Increased US rates often lead to a stronger USD against JPY.

Market Reactions:

Higher rates attract capital inflow into the USD, affecting global risk sentiment.

Traders use tools like Bollinger Bands and Moving Averages to monitor volatility during announcements.

Preparation for Rate Decisions:

Employ stop-loss orders to mitigate sudden price swings.

Analyze historical data on platforms like MetaTrader 4 to anticipate outcomes.

Non-Farm Payrolls and Market Volatility

Non-farm payroll (NFP) reports are a cornerstone for traders managing risk.

Key Features of NFP Reports:

Released monthly by the US Bureau of Labor Statistics.

Directly impacts USD pairs like USD/JPY and USD/CAD.

Risk Strategies for NFP Days:

Use smaller lot sizes to reduce exposure.

Hedge positions with correlated pairs to balance risk.

Trading Tips:

Avoid over-leveraging ahead of volatile spikes.

Consider breakout strategies for post-report trends.

The Role of GDP Data

GDP releases influence trader sentiment and currency strength.

GDP Impact on Currency Pairs

| GDP Event | Currency Pair | Likely Impact | Risk Management Tips |

|---|---|---|---|

| US GDP Growth | USD/CAD | Strengthens USD, weakens CAD | Diversify exposure with non-USD pairs. |

| Australian GDP Lag | AUD/USD | Weakens AUD, boosts USD | Set tight stop-losses on AUD positions. |

| Eurozone GDP Dip | EUR/USD | Weakens EUR, strengthens USD | Hedge EUR exposure using EUR/JPY. |

Risk Management During Inflation Reports

Inflation reports reflect a country’s economic health and impact currency values.

Why Inflation Matters:

Higher inflation often leads to interest rate hikes, boosting currencies like USD.

Pairs like GBP/USD see heightened volatility during inflationary trends.

Strategies to Mitigate Risk:

Incorporate Fibonacci Retracement for setting support and resistance levels.

Use sentiment analysis tools to gauge market expectations before the release.

Example:

Inflation exceeding forecasts in the US typically strengthens USD, affecting pairs such as EUR/USD and AUD/USD.

Central Bank Meetings and FX Risk

Central bank meetings are crucial for forecasting market trends.

Core Impacts:

Unanticipated policy shifts cause sharp movements in pairs like USD/CHF and EUR/JPY.

Market volatility increases, requiring adaptive strategies.

Preparation Tactics:

Monitor central bank schedules on platforms like TradingView.

Leverage economic calendars to predict outcomes.

Hedge volatile positions with correlated currencies.

Insights on Consumer Confidence Indexes

The Consumer Confidence Index (CCI) reflects public sentiment on economic conditions.

Importance in Forex Trading:

A higher CCI typically strengthens domestic currencies (e.g., USD or EUR).

Sentiment shifts influence high-volume pairs like USD/JPY and EUR/GBP.

Trader Applications:

Use support and resistance analysis to prepare for post-announcement price movements.

Employ risk-reward ratios to adjust position sizes.

Example in Practice:

A drop in US CCI might weaken USD, favoring EUR/USD upward movements.

Advanced Risk Mitigation Strategies

Managing risk effectively in Forex trading requires integrating advanced strategies such as trend following, swing trading, and momentum trading. This cluster connects key tools like stop-loss orders and position sizing with practical trading indicators and methods, maximizing control over market volatility.

Trend Following and Risk Control

Using indicators like Moving Averages and MACD helps traders identify low-risk entry points by aligning trades with prevailing market trends. Here's how to implement this approach:

Moving Averages:

Use the 50-day and 200-day Moving Averages to spot trends in EUR/USD or GBP/USD.

A "golden cross" signals upward momentum, while a "death cross" warns of potential declines.

MACD (Moving Average Convergence Divergence):

Monitor the histogram and signal lines for trend confirmation.

When MACD crosses above the signal line, it indicates a bullish opportunity.

Stop-Loss Integration:

Pair trend-following strategies with stop-loss orders to protect against sudden reversals.

Swing Trading Risk Management

Swing trading focuses on capturing medium-term price movements, often holding positions for days or weeks. Effective risk management in this strategy involves:

Set Stop-Loss Levels:

Place stop-loss orders slightly below support levels identified via Bollinger Bands or Fibonacci Retracement.

Determine Profit Targets:

Use resistance zones to set realistic take-profit goals.

Diversify Positions:

Avoid over-concentration in correlated pairs like AUD/USD and NZD/USD.

Leverage Optimization:

Utilize lower leverage to minimize risks during volatile periods, especially around economic events like GDP releases.

Use Position Sizing for Breakout Trading

Breakout trading involves entering positions when prices break through key support or resistance levels. Position sizing ensures traders avoid overexposure in high-volatility scenarios.

| Aspect | Key Considerations | Example |

|---|---|---|

| Position Size Formula | Use 1-2% of account balance per trade. | Account: $10,000, Risk: $200 per trade. |

| Volatility Assessment | Use ATR to estimate breakout strength. | ATR spikes signal increased volatility. |

| Stop-Loss Placement | Place below breakout levels to prevent large losses. | For EUR/GBP breakout at 0.85, set SL at 0.847. |

| Leverage Usage | Reduce leverage to avoid amplifying losses. | Keep leverage below 10:1 for safety. |

Risk Assessment in Momentum Trading

Momentum trading involves capitalizing on sustained price movements driven by market sentiment. Effective assessment combines Stochastic Oscillators and RSI:

Stochastic Oscillator:

Measures overbought and oversold conditions to time entries and exits.

For USD/JPY, buy signals appear when %K crosses %D below 20.

Relative Strength Index (RSI):

Identifies strength in price movements, ideal for determining trade continuation or reversal.

RSI above 70 suggests overbought conditions; below 30 indicates oversold levels.

Combine Signals:

When Stochastic and RSI align, confidence in the momentum increases, allowing for precision in stop-loss and take-profit orders.

Market Analysis for Risk Reduction

Market analysis is crucial for managing risks in Forex trading. Combining technical and fundamental insights, and leveraging tools like trend lines, chart patterns, and sentiment analysis, traders can predict scenarios for pairs like EUR/GBP and USD/JPY while improving decision-making accuracy.

Technical Analysis for Risk Reduction

Technical analysis helps traders identify key support and resistance levels using trend lines and chart patterns, providing a solid foundation for risk management:

Trend Lines:

Drawn along swing highs or lows, these lines help forecast price movements for pairs like EUR/USD or GBP/USD.

Breaks in trend lines indicate potential reversals, enabling proactive stop-loss adjustments.

Chart Patterns:

Patterns like Head and Shoulders or Double Tops highlight potential reversals.

Symmetrical triangles often signal breakouts, requiring careful position sizing to manage risk.

Indicators and Confirmation:

Combine trend lines with Moving Averages or Bollinger Bands to validate trends.

For USD/JPY, Bollinger Bands highlight volatility around key resistance zones.

Sentiment Analysis in Forex

Market sentiment captures the collective mood of traders, aiding in risk predictions for currency pairs:

Currency Sentiment Indicators:

Sentiment tools on MetaTrader 4 reveal bullish or bearish trends for pairs like EUR/GBP and AUD/USD.

Commitment of Traders (COT) reports highlight market positioning.

Social Sentiment:

Monitor Forex forums or trading platforms like eToro for retail trader sentiment.

High bullish sentiment often precedes corrections in overbought pairs.

Application in Risk Management:

Combine sentiment insights with technical tools to refine trade entries and exits.

For example, aligning bullish sentiment with RSI confirmation ensures reduced uncertainty in trades.

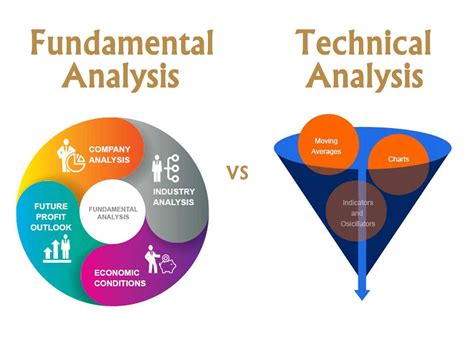

Combining Technical and Fundamental Analysis

Integrating technical and fundamental analysis forms a holistic risk reduction strategy. This combined approach minimizes uncertainty and enhances decision-making in Forex trading.

Technical Analysis Contributions:

Identify key levels using Fibonacci Retracement for EUR/USD, preparing for GDP announcements or central bank decisions.

Pair this with chart patterns to anticipate likely price movements.

Fundamental Analysis Contributions:

Track economic events like Non-Farm Payrolls or inflation reports to understand market drivers.

For USD/CAD, oil price trends often complement fundamental insights.

Comprehensive Risk Framework:

Example: Use trend lines to identify support in GBP/USD ahead of Bank of England announcements.

Reinforce technical predictions with macroeconomic data to validate trade setups.

Comparing Technical and Fundamental Analysis in Forex Trading

| Aspect | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price movements and historical data | Economic events and market news |

| Tools | Chart patterns, trend lines, RSI, MACD | GDP reports, interest rates, inflation data |

| Best for | Short-term risk management | Long-term trend identification |

| Example | Identifying double tops in EUR/USD for short trades | Using inflation reports to forecast USD strength |

| Integration Strategy | Combine with economic insights for holistic trading | Use technical setups for precision entry points |

Conclusion

Effective risk management in Forex trading is the cornerstone of long-term success in this volatile market. By combining strategies like trend following, swing trading, and momentum trading with tools such as stop-loss orders, position sizing, and advanced indicators like MACD and RSI, traders can mitigate risks and optimize returns. Understanding how economic events, trading platforms like MetaTrader 4, and technical indicators interact within a broader risk management framework empowers traders to navigate challenges confidently. Ultimately, mastering these techniques ensures a disciplined approach to Forex trading while building resilience against market unpredictability.